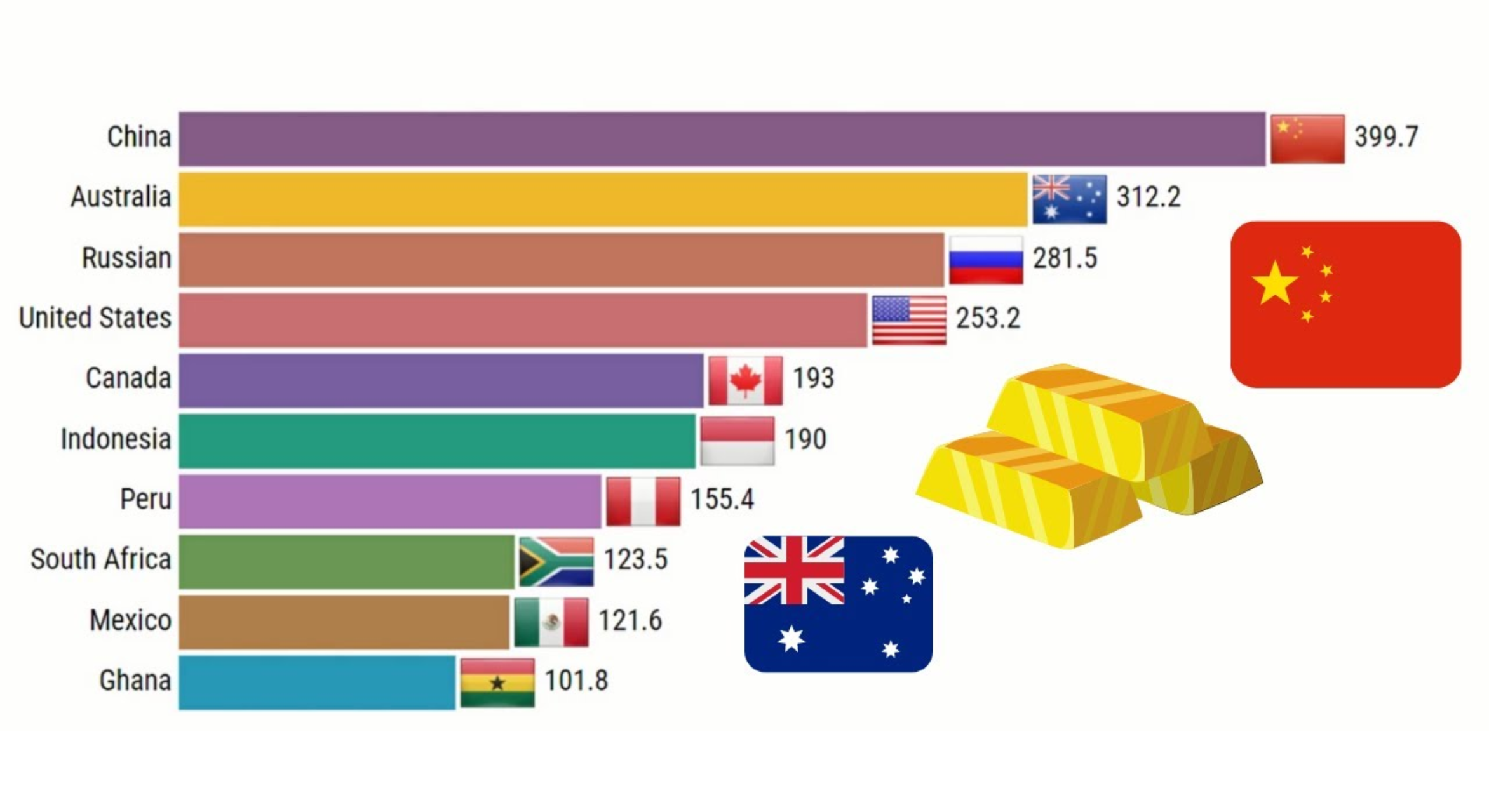

Major countries have been rushing to buy gold since the beginning of 2025, seeking to control this precious metal. Amid economic instability and growing global tensions, buying gold provides a safe haven, prompting major countries to attempt to seize and own new mines and expand their market share.

Below, we will explore the motivation behind this growing demand for gold, highlighting the global reasons behind this rising price.

Future expectations for gold prices

Gold prices have been heading towards new highs since the beginning of 2025, and multiple analysts expect the price to continue rising due to intertwined economic and geopolitical factors. JPMorgan expects the average price of an ounce to reach $2,950, with the possibility of exceeding $3,000. Meanwhile, Goldman Sachs raised its forecast to $3,000, citing increased demand from central banks and the increased likelihood of a recession.

The Financial Times also forecasts that the average price per ounce will reach $2,795 by the end of the year, due to increased demand for precious metals amid a weak US dollar.

UBS also expects gold prices to rise above $3,000 per ounce, reaching $3,200 per ounce within the year. Experts emphasize that gold remains a safe haven for investors during times of global crises, seeking refuge from risk.

Reasons why major countries will buy gold in 2025

Amidst economic conditions and collapsing currencies, the world is searching for a safe haven for its money. Major countries are seeking to secure their share of gold as a safe haven. But what are the motives behind this growing demand?

persistent inflation:

Purchasing gold is a natural hedge against inflation as the prices of goods and services rise across the globe. Its historical value as a commodity with a stable value makes it a safe haven during times of economic turmoil.

Distrust of paper money:

Many global currencies face economic instability and significant volatility, raising concerns about their depreciation. Gold is considered a safe investment alternative, not subject to central bank policies or inflation.

Geopolitical tensions:

International tensions are increasing, with the effects of economic and political instability. Gold is therefore an effective hedge in times of crisis, and investors tend to purchase it as a safe haven asset.

Diversifying the investment portfolio:

For major countries, gold is an essential element in diversifying their investment portfolios. This helps them reduce risks and strengthen and ensure national economic stability.

Growing demand from the private sector:

Demand for gold is increasing among individuals and businesses, prompting major countries to purchase more gold to ensure adequate supplies and meet the growing demand.

Amidst global economic and political conflicts and turmoil, gold remains a safe haven. If you're considering investing in and purchasing gold, it's important to do your own research and definitely browse the Ruby website and choose the gold bullion that best fits your budget, future plans, and financial interests.