In a world of ever-changing financial volatility and economic challenges, a balanced investment portfolio with gold is an essential step towards achieving your long-term financial goals.

Saudi gold is considered one of the finest and most famous types of gold in the world. It is distinguished by its high quality and precision in manufacturing, which is why it is used in the manufacture of a variety of bullion, jewelry, and gold artifacts.

In this article created by Ruby Gold Store, we will learn more about the expectations and trends of the gold market for the year 2024.

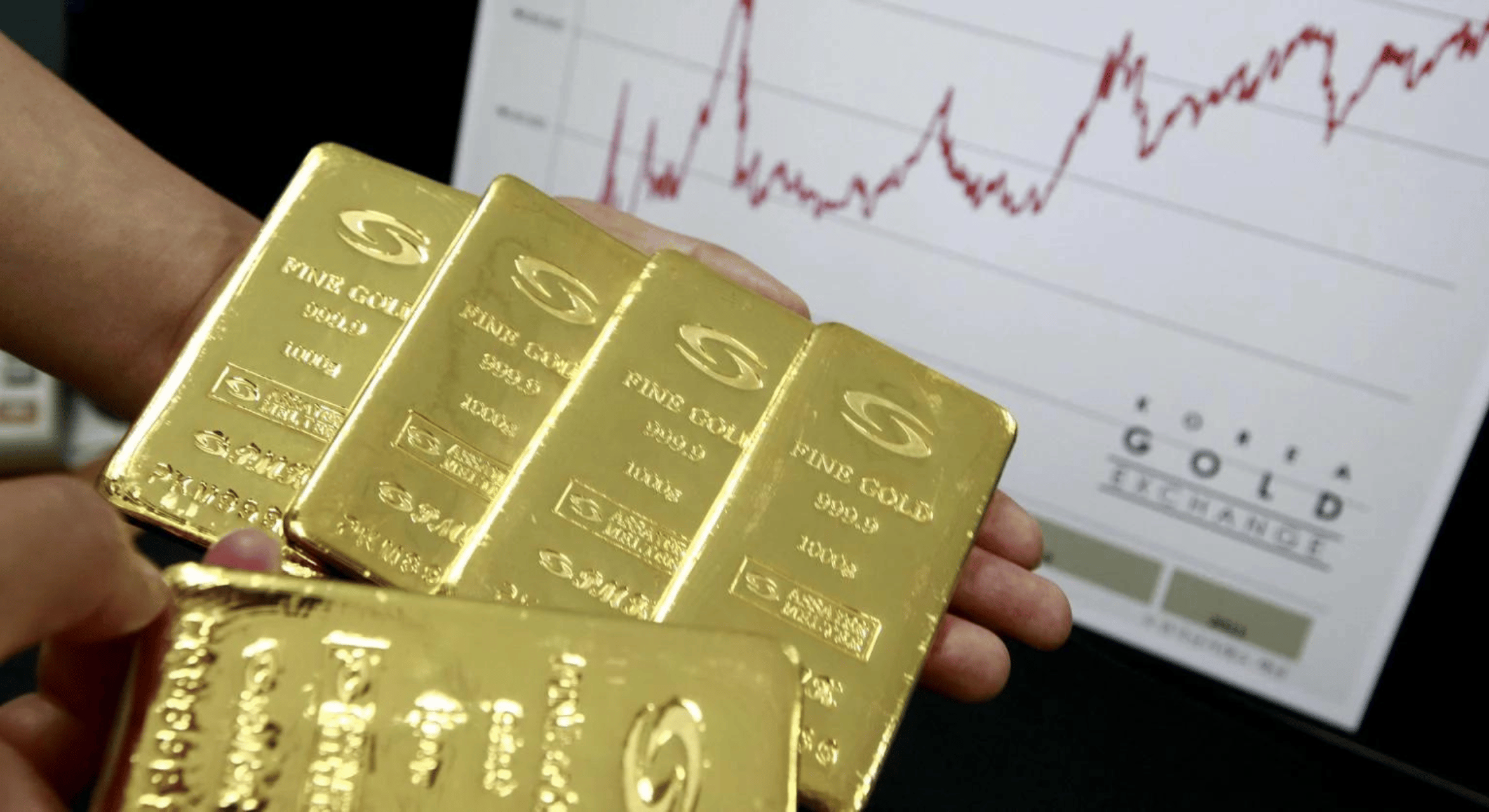

History and trends of gold prices

Gold was used in ancient times as a currency and a means of commercial exchange, and it was able to retain its material value over time. During this period, there was an abundance of gold in large quantities, so its price was relatively low. With the development of trade and mining operations, its price began to rise gradually. At the beginning of the twentieth century, gold recorded a significant increase due to many political changes such as the First and Second World Wars and global economic crises.

With the new millennium, the price of gold changed and rose significantly and significantly, especially after the financial crisis in 2008. Although the price of gold changes constantly, it is considered a safe haven for investment in times of crises. It ensures that you maintain the value of your money, especially during periods of currency fluctuation .

Gold price forecast 2024

Economic events and monitoring supply and demand market changes can give us a glimpse into future gold price trends; According to the expectations of experts and economic analysts, the prices of the yellow metal in Saudi Arabia are expected to rise in 2024.

Goldman Sachs expects the price of gold to rise in 2024 and reach $2,500 per ounce, while JP Morgan expects the price of gold to reach $2,300 per ounce. Despite the inability to accurately predict the price of gold in the future, many Analysts still see gold as a good investment .

Gold prices today, April 28, 2024 in Saudi Arabia.

What are experts’ expectations about the development of the price of gold?

Analysts expect gold prices to remain well above the $2,000 level during the current year as the global gold rush continues. Today's gold price forecast indicates that there is more room to rise even after reaching new record levels. A significant increase in prices is not likely, according to the latest gold price forecasts .

What are analysts’ expectations about the price of gold in 2024?

TD Securities expects gold prices to break new highs in the first half of 2024 as we move closer to the Fed's target and (with) the possibility of a slowdown in the economy. Now you expect that the price will reach the $2,300 level in the second quarter of 2023.

UBS Global Wealth Management said that the rise in gold purchases by central banks globally in five decades and the possibility of President Donald Trump escalating tensions between the United States and China are all reasons to remain optimistic about the price of gold moving forward.

Gold forecast in 2024.

- The World Bank expects the average price of gold to reach $1,950 per ounce in 2024.

- The International Monetary Fund expects the price of gold to average $1,775 per ounce in 2024.

- Goldman Sachs expects the price of gold to average $2,133 per ounce in 2024.

- JPMorgan Chase expects the price of gold to reach $2,175 per ounce in 2024.

- ABN AMRO expects the price of gold to average $2,000 per ounce in 2024.

- Citigroup raised its 2024 forecast for average gold prices to $2,040 per ounce.

- UBS lowered its mid-2024 gold price forecast to $2,200 from $1,950 per ounce.

- Commerzbank expects gold to overcome its all-time high of $2,075 per ounce in 2024.

- ING Bank expects gold prices to rise in 2024.

- TD Securities expects gold prices to average $2,300 in the second quarter of 2024.

- UOB expects the price of gold to reach new highs in 2024.

Concluding this forecast, gold is one of the world's oldest investments - often seen as a hedge against market losses elsewhere - and it continues to gain value. Will the price of gold decline in the coming days and weeks after reaching new highs despite the strength of the stock market and the US dollar? What are the gold price expectations for the next five years?